This ideal is taken seriously by every resident and extends to tax laws as well as other local and state rules. The tax is 625 of the sales price of the meal.

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Alaska Florida Nevada South Dakota Tennessee Texas.

. New Hampshire has opted not to have a state sales tax. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9. New Hampshire also has a 760 percent corporate income tax rate.

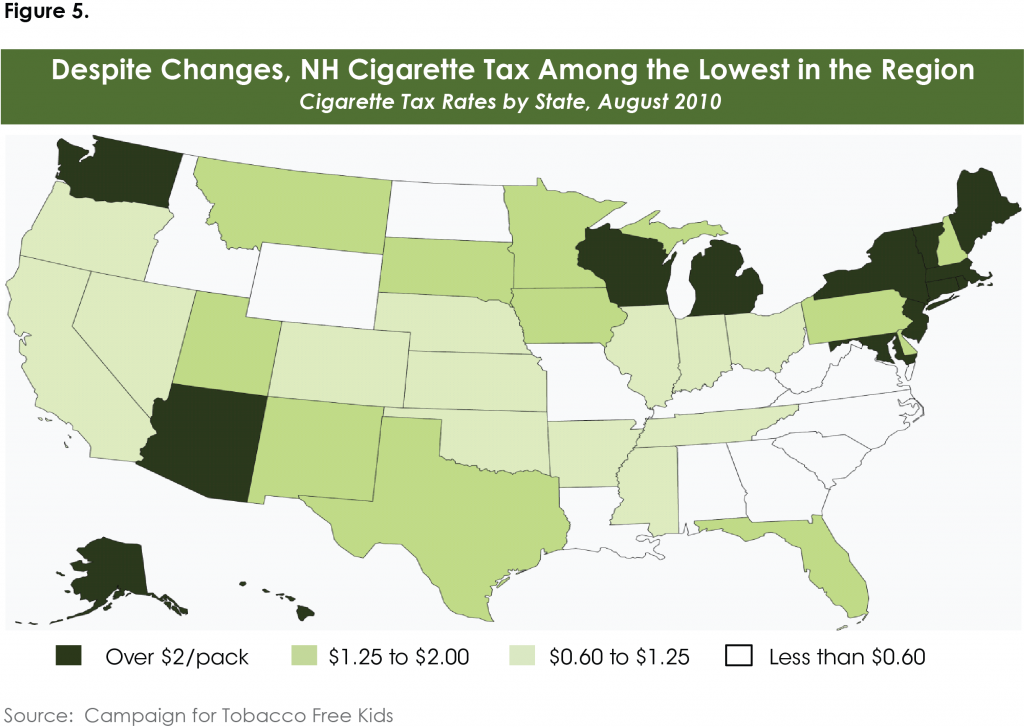

While New Hampshire does not collect a sales tax excise taxes are levied on the sale of certain products including alcohol cigarettes tobacco and gasoline. A 9 tax is also assessed on motor. New Hampshires excise tax on gasoline is ranked 31 out of the 50 states.

If calling to inquire about. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. Depending on the type of business where youre doing business and other specific.

The New Hampshire excise tax on gasoline is 2220 per gallon lower then 62 of the other 50 states. A New Hampshire FoodBeverage Tax can only be obtained through an authorized government agency. Call the Departments Tobacco Tax Group at 603 230-4359 or write to the NH DRA Tobacco Tax Group PO Box 1388 Concord NH 03302-1388.

State sales tax rate. There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals. No state sales tax.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus additional exemptions. Depending on the type of business where youre doing business and.

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents. For additional assistance please call the Department of Revenue Administration at 603. New Hampshire does collect.

Income tax is not levied on wages. The national average sales tax rate is around 511. These are in alphabetical order.

A net rate of 17 is now allocated as 04 AC and 13 UI. There are however several specific taxes levied on particular services or products. However local tax officials may judge that a.

Does Nh Have Food Tax. Are There Exceptions In NH On The 0 Sales Tax. You only have to file a New Hampshire Income Tax Return if you have.

The 2017 maximum benefit permitted for an eligible household of three with no net income is 511 per month which is approximately 549 per person. New Hampshire has a flat 500 percent individual income tax rate which is levied only on interest and dividends income. Does NH have a view tax.

A 9 rooms and meals tax also on rental cars a 5 tax on dividends and interest with a 24004800 exemption plus. Taxes on the self-employed above a. Currently there are seven states in the union that do not levy state income tax.

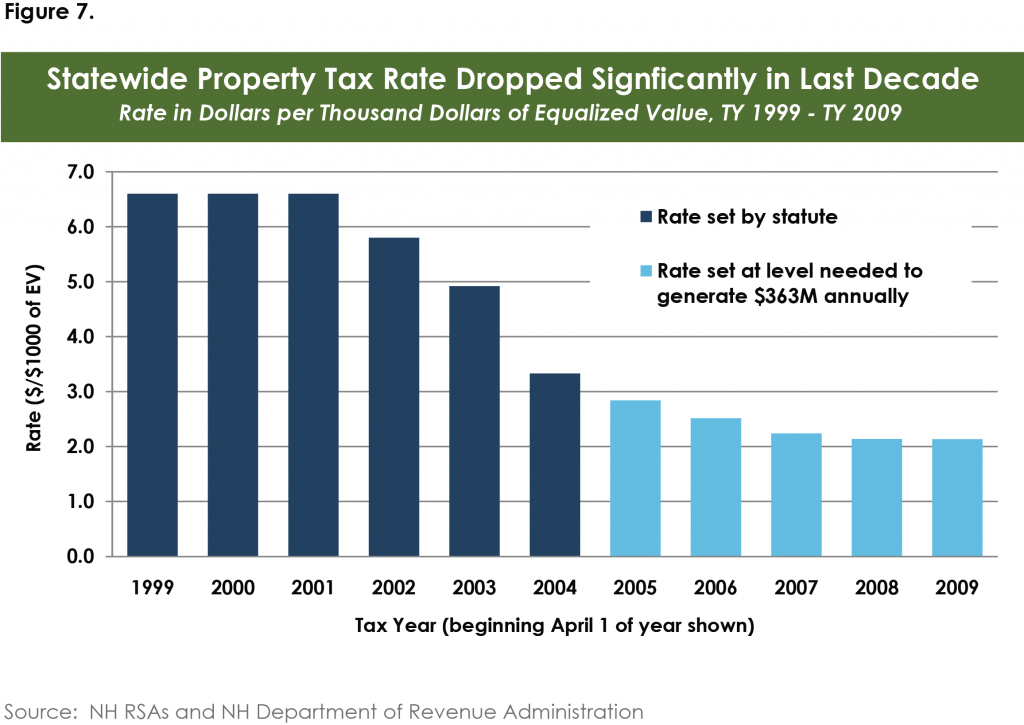

Understanding property taxes in new hampshire. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019. A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

New Hampshire does not have a special statewide tax for properties with a scenic view. New Hampshires individual tax rates apply to interest and dividend income only. A Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on.

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Mark Fernald Why Your Property Taxes Are So High

Families Paying Off Rent Food Debts With Child Tax Credit The Seattle Times

New Hampshire Fights Supreme Court Sales Tax Ruling Wsj

Nh Foods Europe Official Website

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Menu Of Fire 21 Pizza In Conway Nh 03818

New Hampshire S Fiscal Advantages Cato At Liberty Blog

New Hampshire Could Become The Ninth Income Tax Free State Tax Foundation

Hello Tax Reform Goodbye Ballgames Here S What S Changed With Entertainment Deductions Atlanta Business Chronicle

Meals And Rooms Tax Nh Issue Brief Citizens Count

Sununu S Pitch To Suspend Rooms And Meals Tax Worries Town Officials Nh Business Review

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

Selling Homemade Food Products In New Hampshire The Basics Part One Fact Sheet Extension

Biden S Federal Gas Tax Holiday Would It Help Or Hurt Nh Merrimack Nh Patch